Key themes from the HR Executive Health & Benefits Leadership Conference

We spent last week in Las Vegas at the HR Executive Health & Benefits Leadership Conference. I was the program chair for the first three years of this conference, and I was delighted to see the conference grow with such a great energy around it. As a program advisor this year, I had the opportunity to be part of building the program—and the pleasure of presenting several sessions.

We spent last week in Las Vegas at the HR Executive Health & Benefits Leadership Conference. I was the program chair for the first three years of this conference, and I was delighted to see the conference grow with such a great energy around it. As a program advisor this year, I had the opportunity to be part of building the program—and the pleasure of presenting several sessions.

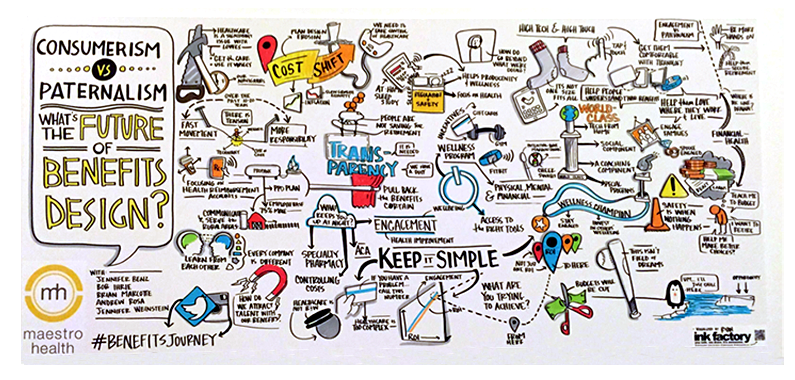

I moderated an all-star panel discussion on the topic, “Consumerism vs. Paternalism: What’s the future of benefits design?” with Jennifer Weinstein of McKesson; Bob Ihrie of Lowe’s Hardware; Brian Marcotte of NBGH; and Andy Rosa of Amerigas. We reviewed the history of benefits, examined the current challenges in health and financial benefits, and discussed the ways leading companies are creating results.

Our conclusion: Employers must deliberately and diligently design benefits programs for good consumer behavior. It is up to employers to ensure their employees are successful by creating cultures that support health and well-being. This means organizations are smartly designing health and wellness plans and programs, and putting resources in place that take the guesswork out of choosing and using benefits.

I also led a fantastic discussion about the financial wellness framework we developed in collaboration with State Street Global Advisors. It’s a six-step, easy-to-implement plan for launching a financial wellness program in the workplace. It delighted me to see the audience truly engaged, and asking great questions.

And, at the last-minute I was asked to join a panel discussion to close out the conference. It was an honor to share the stage with Ron Leopold, National Practice Leader of Health Outcomes at Willis; Jessica van der Wal, head of User Growth at Castlight Health; Nate Randall, founder and president at Ursa Major Consulting; Chris McSwain of McSwain Consulting and formerly head of benefits at Walmart; and Bruce Sherman, medical director at Aasonn and population health management guru.

Top Takeaways:

Benefits are sexy.

Just like we said in our predictions for 2016, benefits are a hot topic, and all of the new providers, technology investments, and energy around new approaches made that evident. It really is an exciting time in benefits, and I’m impressed with what we’re seeing from new companies, and the smart investments being made by established providers.

Engaging employees is a key concern—and opportunity.

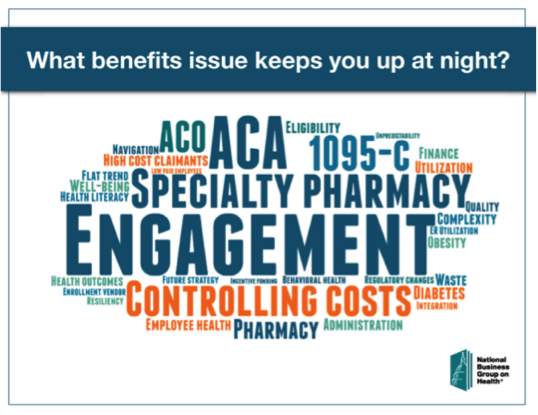

Marketing and the employee experience is top of mind. During the “Consumerism vs. Paternalism” panel, Brian Marcotte of NBGH shared that engagement is among the top issues keeping his members up at night. The word graph below is a visual representation of results from a survey of benefits leaders about what keeps them up at night. The more frequent the answer, the larger the text size.

We are pleased to see the focus on the employee experience, and the awareness that more effort is needed in marketing benefits—not just providing them. Plus, we know the formula to get employees engaged: Help them see why programs are relevant and valuable, then market them year-round. We hope everyone will put the effort into doing just that—because after years and years of less-than-optimal communication, most organizations have a lot of work to do.

Everyone wants to integrate the employee experience.

Many benefits vendors are touting their ability to integrate other benefits vendors, and provide sophisticated tools to get employees the right benefits at the right time. Many want to be the “hub” or single “portal” that unifies the benefits experience.

Overall, this is great news for employers who struggle to keep up with the demands of year-round education, and have limited ability to target and segment based on “just-in-time” data. From the employee experience side, this will simplify access and promote unused resources. To employees, integration makes sense: “Why shouldn’t my financial benefit provider tell me about the health and work/life benefits that are also relevant, and vice versa?” And “Why should I have to remember to go to six different vendors to get everything I need?”

But, a word of caution: When your vendors control the employee experience, your employer brand may get lost in the mix. Employers should not fully relinquish the "employee experience" and their brand to their service partners. It is vital that benefits remain strongly tied to the employer’s brand and value proposition. I spoke about this during the closing panel and a few quotes were captured on Twitter:

The employer needs to own the employee experience and the brand, not the vendors. @jenbenz #BenefitsConf

— Janet McNichol (@jmcnichol) April 1, 2016

ERs should not relinquish the "employee experience" to its service partners @jenbenz #benefitsconf

— Lenny Sanicola (@WorldatWork_Len) April 1, 2016

This is why it’s so vital to have a heavily branded, user-friendly website that’s accessible without a password, outside your firewall. And, as we continue to say, a benefits website is the foundation for branded, year-round education. It gives employees a familiar and easy-to-access front door to all the benefits programs and providers available to them. This is the key to success with our clients, and you can see how those sites look if you check out Adobe and Intuit’s case studies on our site.

We’ll need to question our assumptions and take creative approaches to make a big impact.

Alexandra Drane kicked off the conference with a thought-provoking and insightful discussion of the real cause of much of the health care spend in the U.S.: life. Her thesis: “When life goes wrong, health goes wrong.” Stress is a major driver of what she calls, “Life sucks disease.” She pointed to a recent survey by Eliza Corp., in which 94% of respondents said they felt stressed as a result of dealing with at least one “life issue” connected to finances, family, work, and sleep problems.

Research underscores these findings. And, as evident from the recent focus on stress, mental health, resilience, and financial wellness, the employee benefits industry has recognized these interrelationships, as well.

To really tackle these topics, we’re going to have to get creative with the way programs are designed and marketed. As Alex explained, “We are solving problems that we want solved, not what they [employees] want,” which means we’ll also need to question some of the assumptions that currently go into benefits design.

The time to demonstrate real business results is long overdue.

Tom Parry from IBI led a fantastic discussion around their CFO research and the ways employers can demonstrate more business value. Business results and business impact was a theme throughout the conference. The data is available, the frameworks are there—and it’s now up to benefits leaders, and all of us who support them, to do more to connect the dots between those data sources, and show the true business value of the work and programs.

Let us know your thoughts!

Did you attend the HR Executive Health & Benefits Leadership Conference? Tell us about your experience. Contact us at hello@benzcommunications.com.

Work with Us

We partner with organizations that value their people first. Let’s talk.

Jennifer Benz, SVP Communications Leader, has been on the leading edge of employee benefits for more than 20 years and is an influential voice in the employee benefits industry.