New MetLife tool helps with benefits decisions

“Simplifier” is a good concept and could be outstanding with a few enhancements

MetLife has launched a free consumer tool in response to their 2008 Open Enrollment survey. No surprise that the survey found ”...employees are indicating that they would like greater access to benefits information, guidance and personalized support, which could allow them to conduct thorough research as they do before they purchase other products and services.”

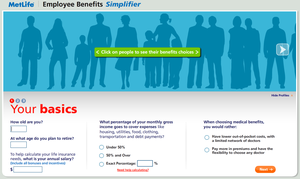

The new tool, the Employee Benefits Simplifier is intended to help employees identify which benefits are right for “people like them,” and offers specific recommendations based on their life stage, including coverage levels and benefits selection.

The new tool, the Employee Benefits Simplifier is intended to help employees identify which benefits are right for “people like them,” and offers specific recommendations based on their life stage, including coverage levels and benefits selection.

The MetLife press release says “The Employee Benefits Simplifier should be a welcome addition to employees, as 79% of employees who receive interactive calculators and decision support tools say that they are extremely or very helpful – the mostly highly valued tools among employees. The vast majority (92%) of employees that received these tools were confident with their benefits decisions, almost 10% more than employees overall (83%). And 83% of employees that used these tools were satisfied with their benefits choices, an increase from 71% of employees overall.” Of course, they note that not many employees actually have access to these tools.

Based on the description, this sounds like an impressive tool. And, it does provide a lot of value for someone who needs a clear easy-to-use overview of common benefit programs. But, I’d like to see them go one step further in a few key areas:

Health plan choices. According to this tool, the only real factors to consider in choosing a plan are out-of-pocket costs and provider choice. It actually says there are only three types of health plans to choose from—HMO, POS and PPO. If only things were still so simple! Many many companies offer high-deductible health plans with HSAs and/or health reimbursement account plans. The tool should at least let users know that those two plans fall in the “PPO” category but a better approach would be to include these very-popular plans in the overall comparison.

Retirement planning and disability are over-simplified. The tool gives good high-level advice about 401(k) contributions, disability and life insurance but does not connect them in a meaningful way. There’s a lot of content to read through and all of the plans are considered as separate components.

Simple money-saving benefits—Flexible Spending Accounts—are an after-thought. If this tool is really targeted at employees, it needs to better promote FSAs, which are offered by almost all employers. The accounts can help free up money to put into a 401(k) or invest in other coverage.

The tool suffers from the same issues as most benefits communication: thinking about each plan on its own. When you consider all benefit programs together, you can see how decisions about health (like enrolling in the FSA and a lower-premium medical plan) can impact options for retirement and insurance by freeing up money to invest in your 401(k) or finding additional money to spend on disability.

Work with Us

We partner with organizations that value their people first. Let’s talk.

Jennifer Benz, SVP Communications Leader, has been on the leading edge of employee benefits for more than 20 years and is an influential voice in the employee benefits industry.