Targeting and Segmenting Benefits Communications: What You Need to Know

You have an incredibly diverse population to engage—diverse in terms of age, family situations, and earnings—in the complicated and overwhelming world of benefits. You also have an enormous amount of data available to you about the people who work for you: their demographics, their salaries, where they live, and their family status, as well as information about the benefits in which they participate. Benefits managers are starting to think like marketers, using this data to predict what employees need and want, and then targeting relevant products and services to them. You can use this data to help your employees make good decisions and to support the programs you’ve put in place. The best way to do that is through targeting and segmentation. Read on for answers to the questions we hear most often about using data to target benefits communication.

1. Why is targeting and segmenting benefits communication important?

Taking a one-size-fits-all approach to your benefits communications won’t allow you to create materials that are relevant and meaningful to everyone. To create communications that have maximum impact, be thoughtful about whom you want to reach the most, how you can help them engage, and what action you want them to take.

Taking a one-size-fits-all approach to your benefits communications won’t allow you to create materials that are relevant and meaningful to everyone. To create communications that have maximum impact, be thoughtful about whom you want to reach the most, how you can help them engage, and what action you want them to take.

Communications are most effective when they’re very focused messages that nudge employees to take the next step, make better decisions, or use your plans and tools better. It’s about customizing the messages to make them more accessible, engaging, and applicable. That’s the essence of targeting and segmenting communications—using the data you have to make your communications more relevant to specific populations of employees.

2. Can I target different employee populations within one general communication?

Absolutely. You can segment even just one piece of communication. For example, if you’re communicating a health plan change that affects everyone—such as a high-deductible plan—you can split the mailer into different sections: one for employees in the PPO plan, one for those in the HMO plan, etc. By creating different scenarios that apply to your population segments, you talk directly to the people who are most likely to make a change.

You can even do this kind of segmentation in fun ways. In a communication piece about retirement, for example, you can offer different paths for people to follow that are based on the type of investor they are. “If you think your understanding is simple, follow this color throughout the piece. If you think you're smart about the plan, follow that color. If you think you know more about it than we do and you're a savvy investor, follow the other color.” In this scenario, employees receive—and digest—complex information in a way that’s relevant to them.

3. What are some good strategies for engaging spouses in the benefits process?

Engaging spouses is critical, especially if you have a heavily male population. Spouses are often the decision makers and the ones driving your costs. The most important investment you can make is to create a benefits website that is outside the firewall. It’s one of the best ways to engage spouses and family members because it’s a user-friendly, helpful tool they can access at any time and from anywhere.

Another effective approach is to send materials to homes. Even the most sophisticated technology companies send print materials to homes to engage spouses and direct them to websites. You can also invite spouses to a webinar series or any benefits-related events you're hosting.

You just want to give spouses plenty of ways to access resources and information. More importantly, talk about the benefits in terms of what’s relevant to their family and how they can get the most out of your programs.

4. What are some of the ways to target communications?

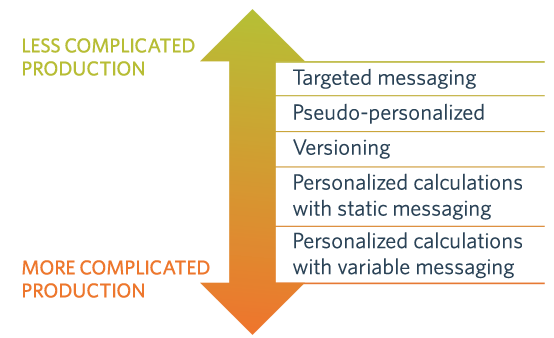

These methods of targeting work for both print and online communications, and are based on the data you’re using to segment messaging to your employees.

These methods of targeting work for both print and online communications, and are based on the data you’re using to segment messaging to your employees.

Targeted messaging. Creating one version of a campaign that speaks to a slice of your employees and dependents who are most likely to change or who need to take a specific action. This is a message and/or imagery that is targeted to a specific population.

Pseudo personalization. This is really a data trick that involves adding someone’s name on any piece of communication you create. The theory here is that because it’s personalized, the recipient is more likely to open it and read it.

Versioning. Creating multiple versions of a piece or multiple versions of a campaign that are based on your data so that you can get people what is most meaningful to them and avoid having them to wade through information that isn’t. This is one of the simplest and most under-used strategies for benefits communication.

Personalized calculations with static messaging. Using data sources like age, salary, or participation in health plans and 401ks to create sophisticated communications that are meaningful and capture an employee’s attention. This type of approach is very high touch and requires intense data testing and sophisticated fulfillment requirements.

Personalized calculations with variable messaging. This technique is the most complicated, but also the most engaging and impactful method of creating targeted communications. With variable messaging, you are using your data to drive specific behaviors based on that specific employee’s health plan enrollment. This approach can be used to drive enrollment in HSA plans that accompany PPOs to save on premiums or be used for wellness messaging based on their participation.

5. Are focus groups a good way of getting feedback from employees?

Absolutely. You can get a lot of information from your employees through focus groups, and it can be a great tool for developing your benefits and communications strategy.

6. How can I target communications electronically without running afoul of HIPAA regulations?

You can do a lot of targeting benefits communication without using individual health data (which is protected by HIPAA laws) or touching areas that are likely to make employees uncomfortable. Some of the most effective strategies direct communications on the basis of plan enrollment, program participation, or location.

But it is always important that your employees understand the measures that protect their data. We talk about this issue in depth in our blog, The challenges of data privacy, health engagement, and employee benefits.

Getting started

For those of us whose work revolves around benefits, it’s easy to forget that not everyone has the same understanding we do. Before you begin any benefits marketing campaign, be sure your employees are grounded in basic health care literacy. Use our 8 health insurance terms every American needs to know with some simple visuals to explain common health insurance words and phrases.

Watch our Master Class!

Companies that make data-driven decisions perform up to 6% better than those that don’t. Rather than let vital employee information go to waste, use it to maximize benefits results. Our webinar, Data drives decisions: Segmentation and targeting benefits communication, offers:

- Insight into the varying types and complexity of data for use in benefits communication.

- Proven methods for personalizing messages to employees and family members who need them most.

- Data-mining techniques to put the employee info you already have to the most effective use.

Work with Us

We partner with organizations that value their people first. Let’s talk.

Jennifer Benz, SVP Communications Leader, has been on the leading edge of employee benefits for more than 20 years and is an influential voice in the employee benefits industry.